-

LEASING OR FINANCIAL LEASING, WITHOUT PERSONAL CONTRIBUTION

- The investment is smoothed over several months in order to distribute the costs for optimal tax exemption (between 13 and 48 months).

- Rents are considered as operating expenses 100% deductible from taxable income.

- By exercising the purchase option, for 3% of the amount financed you become the owner of the work.

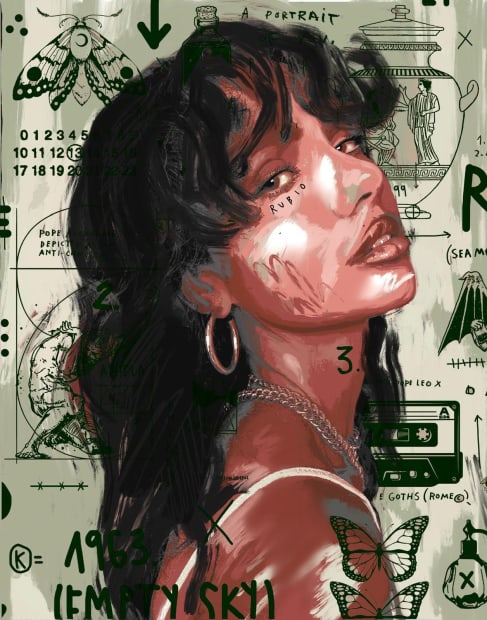

Veronese, Giordan Rubio

YOU DEDUCT FROM YOUR TAXABLE PROFIT 100% OF THE RENTS PAID!

- The work is then depreciable in the same way as any what business equipment that would be leased.

- Leasing creates an operating expense that reduces taxable income and lighten the IS or IRPP of the company allowing great tax savings.

SIMULATION EXAMPLES

AMOUNT OF THE WORK TO BE FINANCED: 20 000 EUROS

Amount

20 000 €

Estimated Tax Rate

25%

Duration

13 months

24 months

36 months

48 months

First rent increase

0 €

0 €

0 €

0 €

Monthly rent in arrears excluding VAT

1 722 €

974 €

681 €

559 €

Tax savings generated

5 746 €

5 996 €

6281 €

6 856 €

Total cost

16 637 €

17 389 €

18 243 €

19 967 €

* As rent is a deductible expense, the tax saving corresponds to the total amount of rent multiplied by the estimated tax rate.

AMOUNT OF THE WORK TO BE FINANCED: 40 000 EUROS

Amount

40 000 €

Estimated tax rate

25%

Duration

13 months

24 months

36 months

48 months

First rent increase

0 €

0 €

0 €

0 €

Monthly rent in arrears excluding VAT

3 427 €

1 940 €

1353 €

1 108 €

Tax savings generated

11 438 €

11 937 €

12 479 €

13 596 €

Duration

33 115 €

34 612 €

36 237 €

39 587 €

* As rent is a deductible expense, the tax saving corresponds to the total amount of rent multiplied by the estimated tax rate.

AMOUNT OF THE WORK TO BE FINANCED: 80 000 EUROS

Amount

80 000 €

Estimated tax rate

25%

Duration

13 months

24 months

36 months

48 months

First rent increase

0 €

0 €

0 €

0 €

Monthly rent in arrears excluding VAT

6 854 €

3 879 €

2 706 €

2 216 €

Tax savings generated

22 877 €

23 875 €

24 958 €

27 191 €

Total cost

66 230 €

69 224 €

72 475 €

79 173€

* As rent is a deductible expense, the tax saving corresponds to the total amount of rent multiplied by the estimated tax rate.